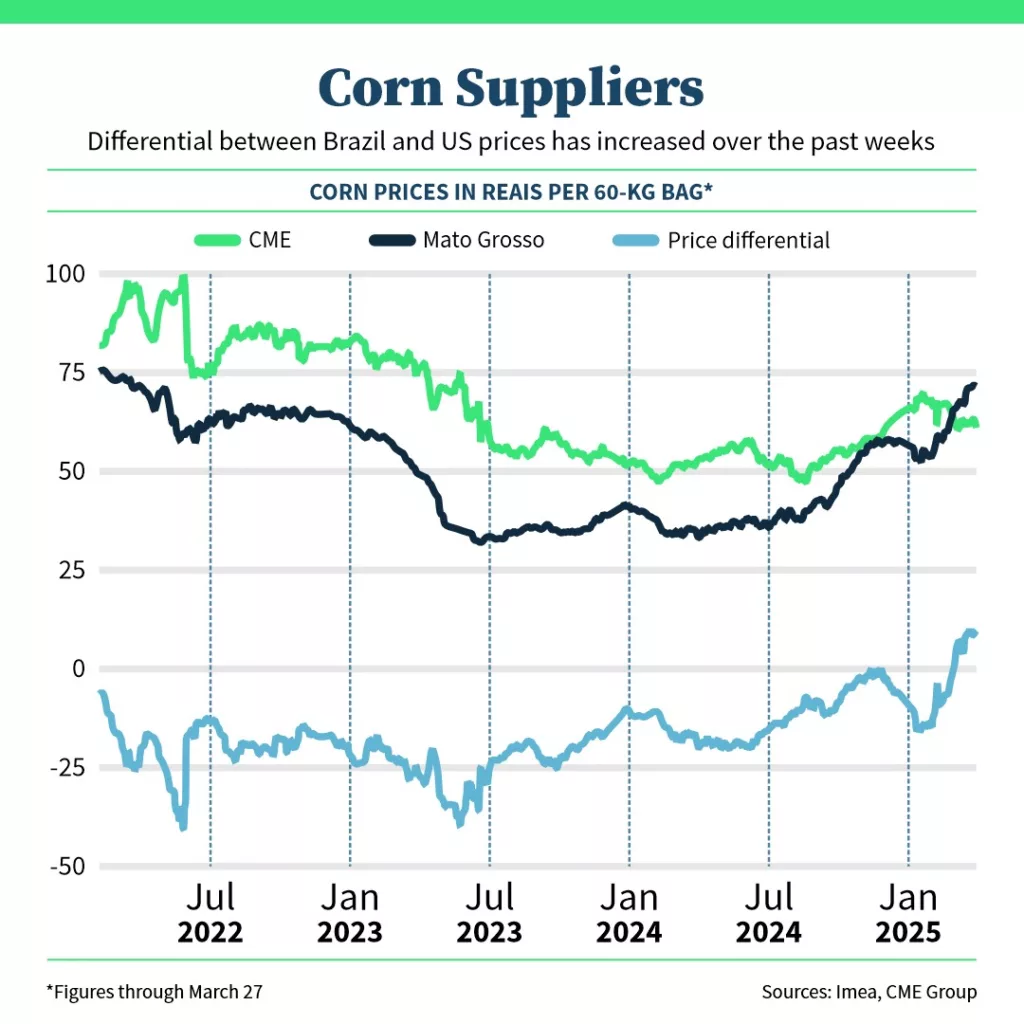

Once the cheapest corn origin in the world, Brazil currently has the most expensive grain among the main suppliers—a situation that exposes a new market dynamic that may result in lower exports from the second-largest exporter.

Spot prices in Campinas, a reference in the Brazilian market, were at 88 reais per 60-kilogram bag last week, or $255 per ton, according to AgRural consultancy firm.

The local price, the highest since 2022, exceeds corn export prices in the US and Argentina, at $205 and $238 a ton, respectively. It is even higher than prices in Ukraine ($238 per ton).

In fact, only local consumers are paying these high prices for the grain as Brazil is currently out of the export market —ports are totally focused on soybean shipments and farmers are planting the second corn crop, the most important in the nation accounting for almost 80% of total production. The harvest kicks off in June.

In recent years, Brazilian corn prices have rarely been more expensive than those in the United States. That was the case in 2016, when Brazilian production tumbled on adverse weather, leading meat producers to import corn from nations like Argentina and the U.S.

In recent years, however, the story has been different: Brazil’s bumper crops have boosted corn exports, allowing the country to surpass the U.S. as the world’s largest corn supplier in 2023.

Still, production declined last year due to adverse weather conditions in Mato Grosso, the country’s largest producing state. While feed demand remained strong and shipments continued at a satisfactory pace, the growing corn ethanol industry further tightened supply.

“With lower production, good exports, and ethanol plants boosting demand, the meat sector became alarmed and started offering higher prices to encourage farmers to sell the corn they had been hoarding,” said Daniele Siqueira, an analyst at AgRural. “And when farmers see buyers offering higher prices, they ask for even higher prices. It’s a snowball effect.”

That’s the current situation in Brazil. “Industries running out of corn inventories are paying whatever it takes to secure corn,” the analyst said.

Chicken Margins

Over the past 12 months, feed costs—which account for about 70% of poultry and pork production costs—have risen by 11% in Brazil, according to an Embrapa index.

Fourth-quarter earnings from BRF and JBS’ Seara, Brazil’s largest chicken producers, showed poultry margins have declined from a peak in the third quarter last year. The Chief Executive Officer of JBS, Gilberto Tomazoni, emphasized in an interview last week that Brazil has the world’s most expensive corn.

“If there are no unexpected weather events in the coming months, there is a greater chance that corn prices will fall rather than rise. We may even see a reduction in costs,” said Tomazoni, noting that April and May are crucial for determining the size of Brazil’s second corn crop, also known as “safrinha”.

So far, the crops in Mato Grosso have had a good start, according to Siqueira. However, other producing states have experienced a dry month and a higher risk of frost losses this autumn as plantings have been delayed this year.

Prices should remain firm until the safrinha harvest kicks off in June. “When the harvest begins, prices will fall. The question is how much,” said Siqueira.

André Pessôa, CEO of Agroconsult, said corn prices in Brazil should remain about R$10 above last year’s levels. “If the production fails due to weather issues, there will be a smaller export surplus,” he said in an interview last week.

“Despite the recent growth, Brazil is still a surplus exporter,” said Siqueira. “US exports have regained the corn market strongly. If US farmers reap a good crop again, they will easily dominate the global market.”

On Monday, the US Department of Agriculture reported US farmers will increase corn plantings by 5% in 2025/26 to the largest area since 2020.