The long-awaited JBS share listing in the US is closer than ever. After nearly two years of negotiations, JBS has secured approval from BNDES to list its shares in New York —a move with the potential to triple the market value of the Brazilian company and unlock a powerful financing mechanism for acquisitions.

J&F, the holding company controlled by the brothers Joesley and Wesley Batista, has signed an agreement with BNDESPar —the equity investment arm of the state-owned bank BNDES— ensuring that the bank will not vote against the transaction in a shareholder meeting yet to be scheduled.

Under the terms of the agreement, BNDESPar, which holds a 20.8% stake in the meat giant, will abstain from voting in the shareholder meeting that will discuss the matter, leaving the decision to minority shareholders, whose majority support the US listing.

As the Batista brothers, who own 48.3% of JBS, are already unable to vote in the shareholders’ meeting, the BNDES position is crucial for a favorable outcome. If the state-owned bank opposed the NY listing —which occurred in 2016, the ballot would be much tighter, and minority shareholders might not have enough votes to approve the transaction.

BNDESPar has guaranteed a minimum remuneration of as much as 500 million reais ($87.6 million). This amount will only be paid to BNDES if JBS shares in the New York Stock Exchange appreciate less than a certain threshold, to be verified in December 2026 —the strike price has not been disclosed.

With this deal, BNDES ensures that the U.S. listing will be profitable for the bank, which has already accumulated substantial gains from its investments in JBS between 2007 and 2011.

The Listing’s Potencial

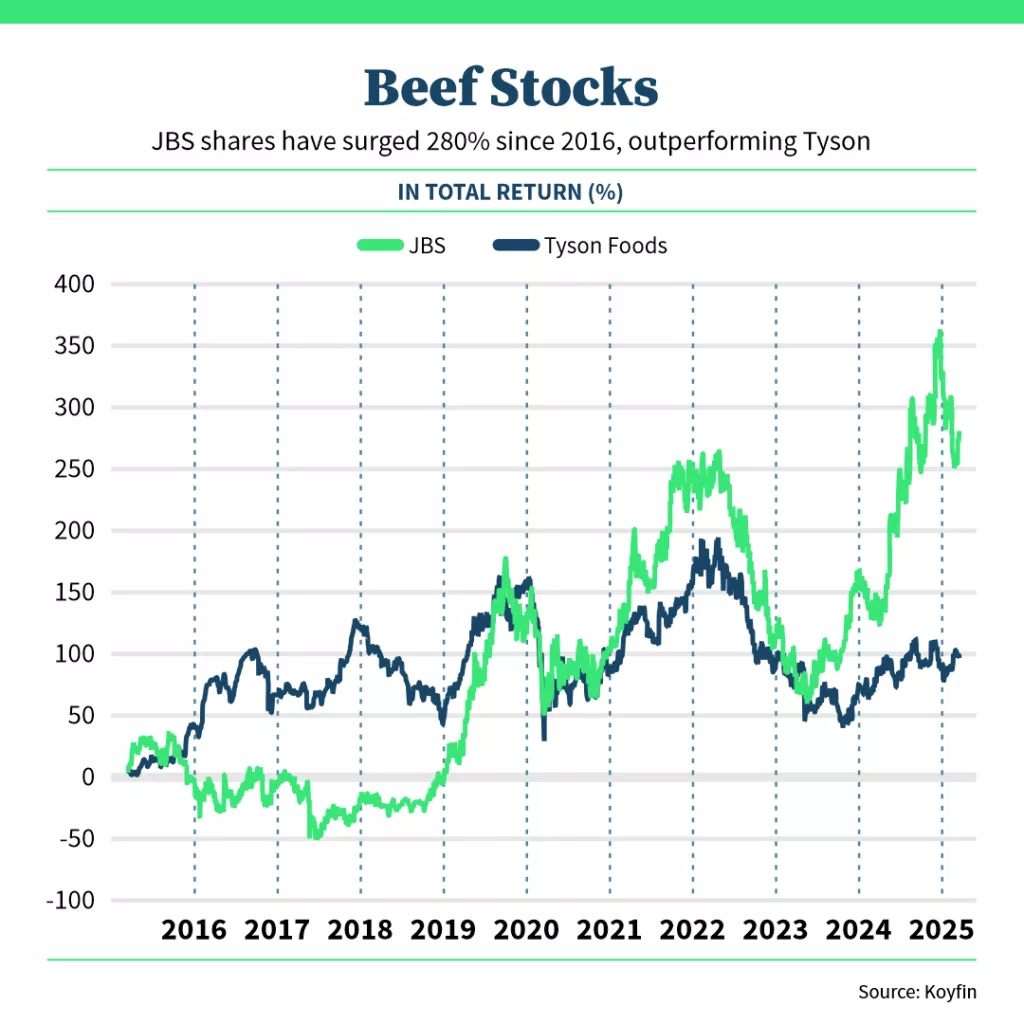

Since JBS first explored the possibility of listing its shares on the New York Stock Exchange more than a decade ago, the company has consistently argued that the move would unlock value by bringing its valuation metrics closer to those of U.S.-listed competitors.

Smithfield is a good example. Controlled by China’s WH Group, the pork giant recently returned to the New York Stock Exchange. Even with an IPO below expectations, its shares trade at an EV/EBITDA multiple of 8x, while JBS trades at just 5x.

If JBS were already trading at the same multiples as Smithfield, its market value would more than double, surpassing 150 billion reais ($26.3 billion).

Given JBS’s advantages over the bacon giant, this is not an unlikely scenario. JBS is more diversified in terms of types of protein and geographically —Smithfield only produces pork. The Brazilian firm has been also growing faster. Over the past five years, the Brazilian company’s EBITDA has grown by an average of 14% per year. In the same period, Smithfield’s EBITDA has declined by an average of 5%.

JBS’s potential appreciation through a U.S. listing could be even greater when compared to Tyson Foods’ multiples. Valued at $21.6 billion, Tyson trades at a multiple of 8.4x. If JBS were valued at the same level, its market capitalization would triple.

Even in a more conservative scenario, the upside remains significant. Pilgrim’s Pride, a U.S. poultry company listed on Nasdaq and controlled by JBS, trades at a multiple of 6.5x. Reaching that level would almost double JBS’s valuation.

JBS executives often highlight that a major source of value extraction lies in passive fund allocations, which track major U.S. stock indices. Currently, 60% of animal protein company allocations come from passive funds, with asset managers like Vanguard and BlackRock building significant positions in companies such as Tyson.

In the short term, JBS could already be included in the Russell 1000 Index, which has a combined market capitalization of $10 trillion. Given that over 50% of its sales come from the U.S., the company could also aim for inclusion in the S&P 500 later on, which would place it in an index with over $13 trillion in capitalization.

The Bonds Case

To some extent, the U.S. bond market has already provided a clue of JBS’s revaluation potential.

Since registering its debt securities with the SEC and beginning to report periodic financials like a U.S.-listed company, JBS has drastically reduced its interest rate spread compared to Tyson—from 3 percentage points to just 0.2 points.

Registering its bonds has also placed JBS among the food and beverage industry giants. The company is now part of Barclays’ fixed-income sector index, representing 7.4% of the total —trailing only AB InBev (17%), PepsiCo (12%), and Coca-Cola (9.6%).

Next Steps

To complete its U.S. listing and reap the benefits anticipated by much of the market, JBS must still go through several steps. The next one, following the release of last year’s financial results—scheduled for March 25—is to submit a new request to the SEC.

Simultaneously, the company must schedule a shareholder meeting in Brazil, which is likely to happen within the first half of the year, with the listing potentially occurring in the third quarter.

BNDES’ Return

BNDESPar have invested a total of 8.1 billion reais in JBS shares. Despite the controversies along with this long-standing relationship, BNDES’s investment in JBS has proven to be highly profitable—and probes into these investments have cleared the bank’s technical staff of any wrongdoing.

With an average purchase price of 8.58 reais per share, BNDESPar boasts an internal rate of return of 11.35% per year on its JBS investment. In the same period, the Ibovespa index returned 7.25% per year.

So far, JBS has generated nearly 23 billion reais in profits for BNDESPar. With the dual listing in the U.S., expectations are that these profits will increase even further.